PRIVATE CLIENT

Investor Relations

Entrepreneurs Banking Entrepreneurs Since 1912

PRIVATE CLIENT

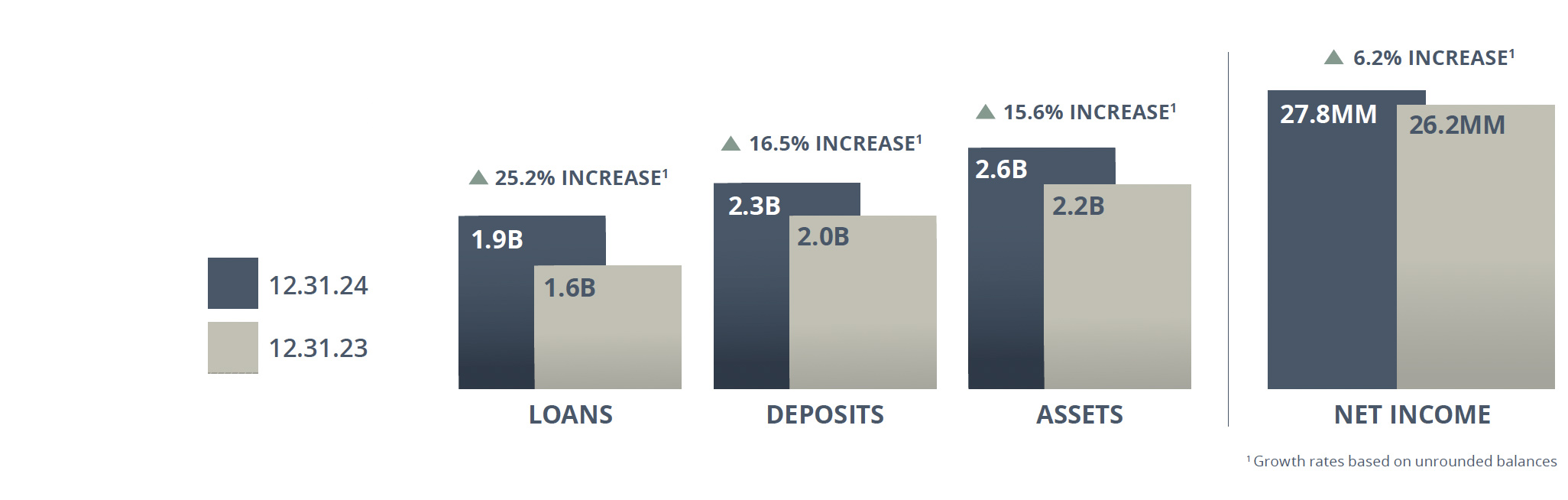

2024 was the strongest year in Vista Bank's 113-year history.

For over a century, Vista Bank has been financing the American Dream for those who dare to chase it. That entrepreneurial spirit has served us and the small and mid-cap companies we are humbled to call clients well over the years.

And while it took 108 years to reach $1 billion in assets, it only took us three years to eclipse the $2 billion mark. We are pleased to share that 2024 was no exception. Vista maintained robust liquidity, increased our earnings, and continued our growth trajectory, resulting in the strongest year in the Bank’s 113-year history.

Vista Bank at a Glance*

Vista Bancshares is a 113-year-old community bank holding company with $2.6 billion in assets and 18 locations spanning North, Central, West Texas and Palm Beach, Florida. With an innately conservative credit culture, Vista has a demonstrated history of maintaining resilient asset quality through a century of economic downturns. Having built a diverse loan portfolio with short-term maturities, Vista focuses on disciplined organic loan growth and strategic M&A opportunities. The board, founding family, and senior management control 39% of the total shares, closely aligning our daily purpose with shareholder interest. Finally, in the past seven years, we’ve invested more than $32 million in people, software and information technology which speaks to our commitment to proactive risk management.*

- Privately owned

- Domiciled in Dallas, Texas

- CEO: John D. Steinmetz

- Asset Size: $2.6 billion

- Total Loans: $1.9 billion

- Total Deposits: $2.3 billion

- Valued Clients: 16,787

- Valued Team Members: 236

Unaudited

*per publicly filed December 31, 2024 call report

2024 Financial Highlights*

*per December 31, 2024 publicly filed call report.

December 31, 2024 YTD Financial Highlights

- YTD Net Income of $27.8 million.

- Returns on Average Assets and Equity of 1.20% and 11.26%, respectively.

- Robust Net Interest Margin of 3.98% and low Efficiency Ratio of 58.53%.

- Strong annualized loan and deposit growth of 25.22%.

- Strong liquidity with cash and securities representing approximately 16.8% and 5.7% of total assets, respectively.

*per publicly filed December 31, 2024 call report

Investor Contact: Matt Willis, Executive l Board Secretary & Director of Investor Relations – [email protected]